The 2024 cryptocurrency bull market is characterized by remarkable growth and optimism in the cryptocurrency sector.

Bitcoin, the dominant cryptocurrency, continues to reach new all-time highs, alongside other altcoins like Ethereum, Solana, Dogecoin, and Shiba Inu, which have also seen substantial gains. This bull market displays strong market depth, as the overall crypto market cap exceeds $2 trillion, signaling a widespread rally that goes beyond Bitcoin and Ethereum.

The prevailing positive price momentum and increasing investor confidence indicate that this bull run could be prolonged and extend over several months.

What were past bullies in the cryptocurrency market?

- 2011: Bitcoin rose from 8 cents to $30 when a large number of new traders joined the cryptocurrency trade, pouring new money into Bitcoin ETFs. This led to a rapid increase in prices. After reaching its historical maximum, the exchange rate decreased by 90%.

- 2013: Then the price of Bitcoin rose from $13 to $1,000. During the year there were several price jumps, and the exchange rate gradually rose until it entered a rapid growth phase and reached $1,000 in November. After reaching a maximum by December, the rate dropped to $500.

- 2017: In January, the exchange rate returned to $1,000 and subsequently rose to $19,000. By May, it doubled, and by December, it had reached a new historical high. The exchange rate rose in leaps and bounds due to traders' uncertainty regarding the price movement vector. After reaching a maximum, the price dropped to below $10,000.

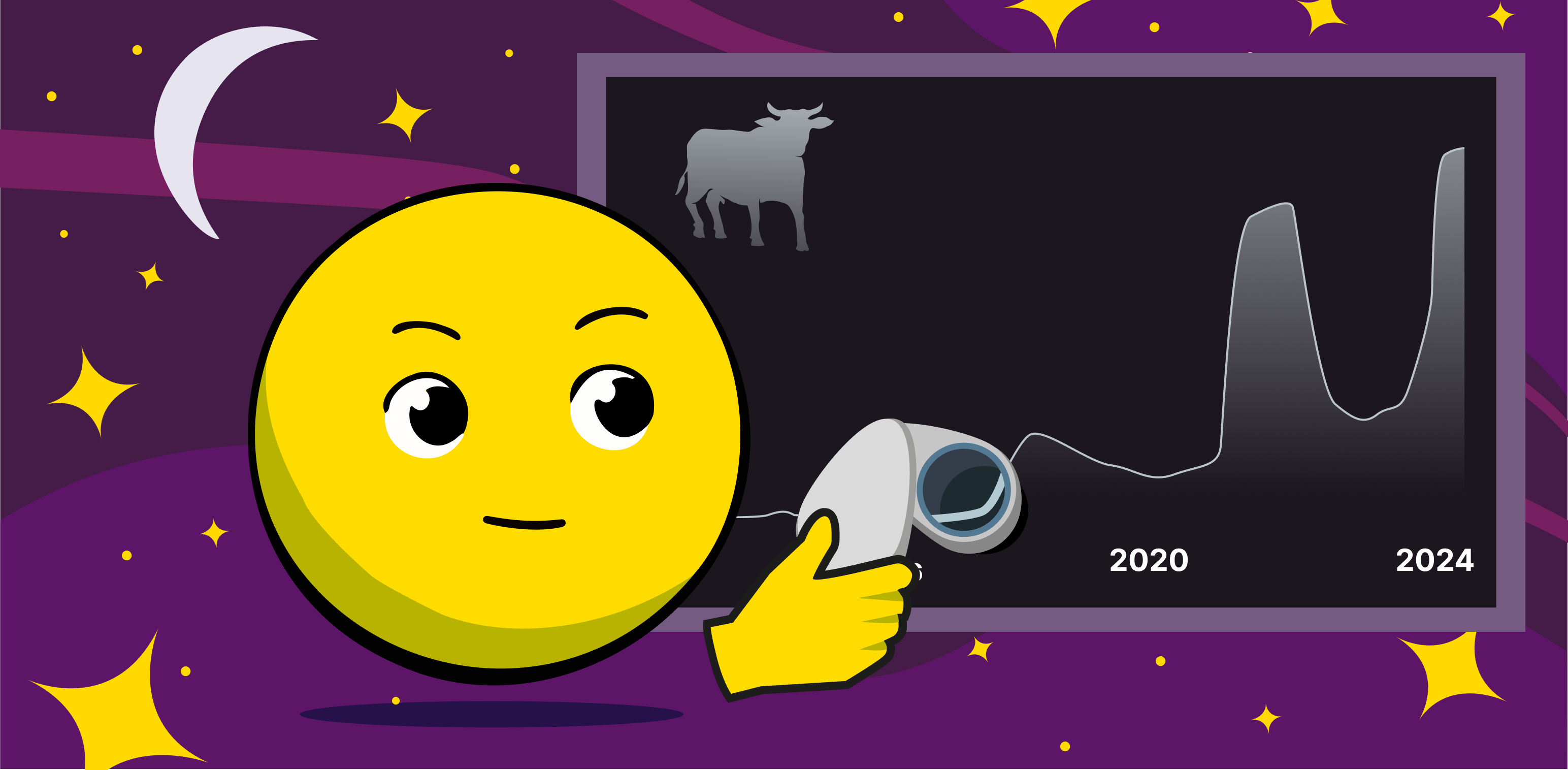

- 2021: During the last bull market, the price of Bitcoin rose from $10,000 to $69,000. Since the fall of 2020, the trend has turned towards growth, and by April 2021, it has reached $64,000. Subsequently, there was a drop of more than two times. The exchange rate recovered in November, reaching US$ 69,000. After updating the historical maximum, the exchange rate begins to decrease. Bitcoin spent the entire year 2022 in a downward trend, dropping to $15,500. Growth began at the beginning of 2023 and accelerated in October.

Analysis of the current crypto market

Historically, Bitcoin bull runs have been closely tied to its halving events, which occur roughly every four years. The pattern typically observed was that the market would gradually gain momentum after a halving, eventually reaching a peak around 1.5 years later.

However, the most recent bull run deviated from this pattern. Bitcoin's all-time high was achieved before the 2024 halving event, breaking the traditional cycle.

Based on the indicators mentioned above, we assess the current state of the cryptocurrency market and the potential for a new bullish rally in 2024.

- Prices: After a prolonged bear market in 2023, the prices for major cryptocurrencies began to show signs of recovery in early 2024, with Bitcoin and Ethereum gaining momentum. In particular, the events of early 2024 (from inflation data in March, the spread of Bitcoin ETFs, and the hype before halving) provoked a new record price for the main cryptocurrency of $73,135.

- Investor sentiment: The fear and greed index steadily rises, indicating a shift towards more positive sentiment among investors. This index shows the general mood of cryptocurrency market investors. At the moment, it is at the level of 71, although in the last week, the number 69 was listed.

- Adoption and mass integration: Several large companies and financial institutions have announced plans to integrate cryptocurrencies into their services, implying a wider distribution. For example, Burger King and Starbucks introduced crypto-payments to pay orders in 2024.

- Regulatory landscape: Regulators in key markets have taken steps to ensure the clarity and legitimacy of the cryptocurrency industry, paving the way for further growth. One such example is the approval of the Bitcoin ETF, which took place in January 2024.

- Technological advances: Developments in areas such as decentralized finance (DeFi), non-interchangeable tokens (NFT), and layer 2 scaling solutions have generated new interest in the crypto ecosystem.

Reasons behind the 2024 bull run

Institutional adoption

One of the most significant differences is the level of institutional adoption and investment in the crypto space. Institutional interest is one of the main factors that has helped stabilize the cryptocurrency market after its crash by providing more liquidity. Currently, many institutions are actively investing in this area. This has become more evident than in the asset management industry.

In the previous bull runs, retail investors largely drove the market. However, now we can see a surge of “big” money flowing into the cryptocurrency market through hedge funds, banks, and even publicly traded companies adding Bitcoin and other digital assets to their portfolios. Square and MicroStrategy shocked the business world by placing some of their cash reserves in Bitcoin. Another example is PayPal and its subsidiary Venmo, which launched cryptocurrency trades on their platforms.

Regulatory clarity

2024 is a year of increased regulatory clarity in the cryptocurrency market. The 2017 ICO craze ushered in an era of increased government control, but regulators in various countries now seem to have reduced their concerns about cryptocurrencies, as evidenced by the case of Ripple and its victory over the SEC in court. In recent years, many countries have introduced clear regulations for cryptocurrencies that provide more certainty to investors and businesses. This has helped to reduce risk and attract more institutional players to the market.

Technological advancements

The crypto industry has also seen significant technological advancements in recent years with the development of layer-2 scaling solutions, decentralized finance (DeFi) protocols, and nonfungible tokens (NFTs). These innovations have expanded the use of cryptocurrencies and attracted new users to the ecosystem. The growing popularity of DeFi and NFTs has contributed to the current bull.

Macroeconomic factors

Finally, the current bull run is also influenced by macroeconomic factors such as low interest rates and concerns about inflation. With traditional assets such as stocks and real estate becoming increasingly expensive, some investors are turning to cryptocurrencies as a hedge against inflation and as a way to diversify their portfolios. The COVID-19 pandemic and the growth of political tension around the world have also accelerated the adoption of digital technologies, including cryptocurrencies, as more people have turned to online platforms for financial services and transactions.

Despite these differences, the current bull run is still subject to the same risks and volatility that have characterized previous crypto-bull markets. The market remains highly speculative, and a significant correction or bear market can occur at any time. Investors should exercise caution and conduct their research before investing in cryptocurrencies.

Long-term outlook

The price of Bitcoin has a significant impact on the overall market, often serving as a trendsetter and influencing the direction of other cryptocurrencies and financial assets. Thus, so far, the long-term outlook for the cryptocurrency market remains positive.

Some investors predict that Bitcoin's halving in 2024 could have sparked another massive bull run with Bitcoin price potentially reaching $150,000 or higher causing the exponential growth of altcoins in the future. Others assume that its value will increase slightly with no sharp jumps, as observed earlier.

Tom Lee, the co-founder of Fundstrat, suggests that the value of Bitcoin will rise to $87,875 by the end of 2024, with some experts predicting it could climb as high as $200,000. Lee believes this will lead to a lower supply and higher prices for the whole market.

Analysis of the Pantera Capital Fund predicts that the cost of Bitcoin could reach $147,000-$148,000 because of the upcoming reduction in cryptocurrency issuances, as a similar phenomenon has already been observed in the past. In their opinion, a 100% growth was possible.

Markus Thielen, the head of the analytical department at the Matrixport service, declares the potential growth of Bitcoin to $125,000, influencing the direction of other cryptocurrencies and financial assets.

Adam Back, CEO of the blockchain company Blockstream, holds a similar point of view.

Analysts at one of the largest banks, Standard Chartered, predict a lower cost for Bitcoin, believing that it will stop at the $100,000 mark.

Given that Bitcoin's price movements are closely monitored as a gauge of market sentiment, the projected average price target of $100,000 for Bitcoin by the conclusion of 2024 could have wide-ranging implications for the financial landscape.

However, it is crucial to note that these remain forecasts, the economic landscape always offers surprise turns, and there is no complete knowledge of this market. Investors should approach this potential bull run with caution, avoiding common mistakes such as overinvesting or chasing sudden pumps.

Conclusion

The current crypto-bull run is a testament to the market's maturity and the increasing acceptance of cryptocurrencies as a legitimate asset class. While institutional adoption and evolving regulations have brought stability and legitimacy to the space, they have also introduced new challenges and risks.

As we look ahead to the potential of another bull run in 2024, it is clear that the cryptocurrency market has come a long way. However, the lessons of the past remain relevant: investors must approach the market with caution, diversify their portfolios, and prepare for the inevitable volatility that comes with investing in this exciting and rapidly evolving space.