In the realm of cryptocurrency, few events rival the intrigue and anticipation surrounding the Bitcoin halving. Like clockwork, this phenomenon occurs approximately every four years, eliciting fascination from enthusiasts, investors, and analysts alike. It represents a pivotal moment in the trajectory of Bitcoin, ushering in a significant adjustment to its underlying mechanics. At its core, the halving event entails a halving of the reward granted to miners for verifying transactions, effectively reducing their earnings by 50%. This deliberate reduction in block rewards is not arbitrary but ingrained within the very fabric of the Bitcoin protocol. Its purpose? To meticulously manage the inflation rate and, ultimately, to confine the total supply of bitcoins to a finite 21 million.

Historical Context

The concept of the Bitcoin halving can be traced back to the very design principles laid out by Satoshi Nakamoto, the pseudonymous creator of Bitcoin. By introducing a halving mechanism into the protocol, Nakamoto ensured that the issuance of new bitcoins would follow a predictable and diminishing schedule. This scarcity mechanism is central to Bitcoin's value proposition, as it distinguishes the cryptocurrency from fiat currencies that can be subject to inflationary pressures.

The timing of Bitcoin halvings is predetermined, occurring once every 210,000 blocks, roughly every four years. Since the inception of the Bitcoin network in January 2009, there have been three such halving events, with the most recent taking place in 2020.

The inaugural Bitcoin halving occurred in November 2012, approximately four years after the cryptocurrency's inception. At that time, Bitcoin was still in its nascent stages, with a relatively small user base and limited mainstream recognition. The halving, however, served as a catalyst, drawing attention to Bitcoin's unique monetary properties and its potential as a store of value. Following the event, Bitcoin experienced a surge in price, catapulting it into the spotlight of mainstream media and sparking a wave of interest from investors and technologists alike.

The second halving took place in July 2016, marking another milestone in Bitcoin's evolutionary journey. By this time, Bitcoin had gained considerable traction, with a growing ecosystem of exchanges, wallets, and applications supporting its use. The 2016 halving event occurred against the backdrop of increasing institutional interest in Bitcoin and the growing acceptance of cryptocurrencies as a legitimate asset class. Once again, the halving event was accompanied by a surge in price, as investors sought to capitalize on the perceived scarcity of bitcoins.

The third halving occurred in May 2020, amidst a backdrop of global uncertainty and economic turmoil induced by the COVID-19 pandemic. Despite the challenging macroeconomic environment, Bitcoin emerged as a resilient asset, with its decentralized nature and fixed supply appealing to investors seeking refuge from traditional financial markets. The 2020 halving event reignited the debate surrounding Bitcoin's role as a hedge against inflation and spurred renewed interest from institutional investors and corporate treasuries.

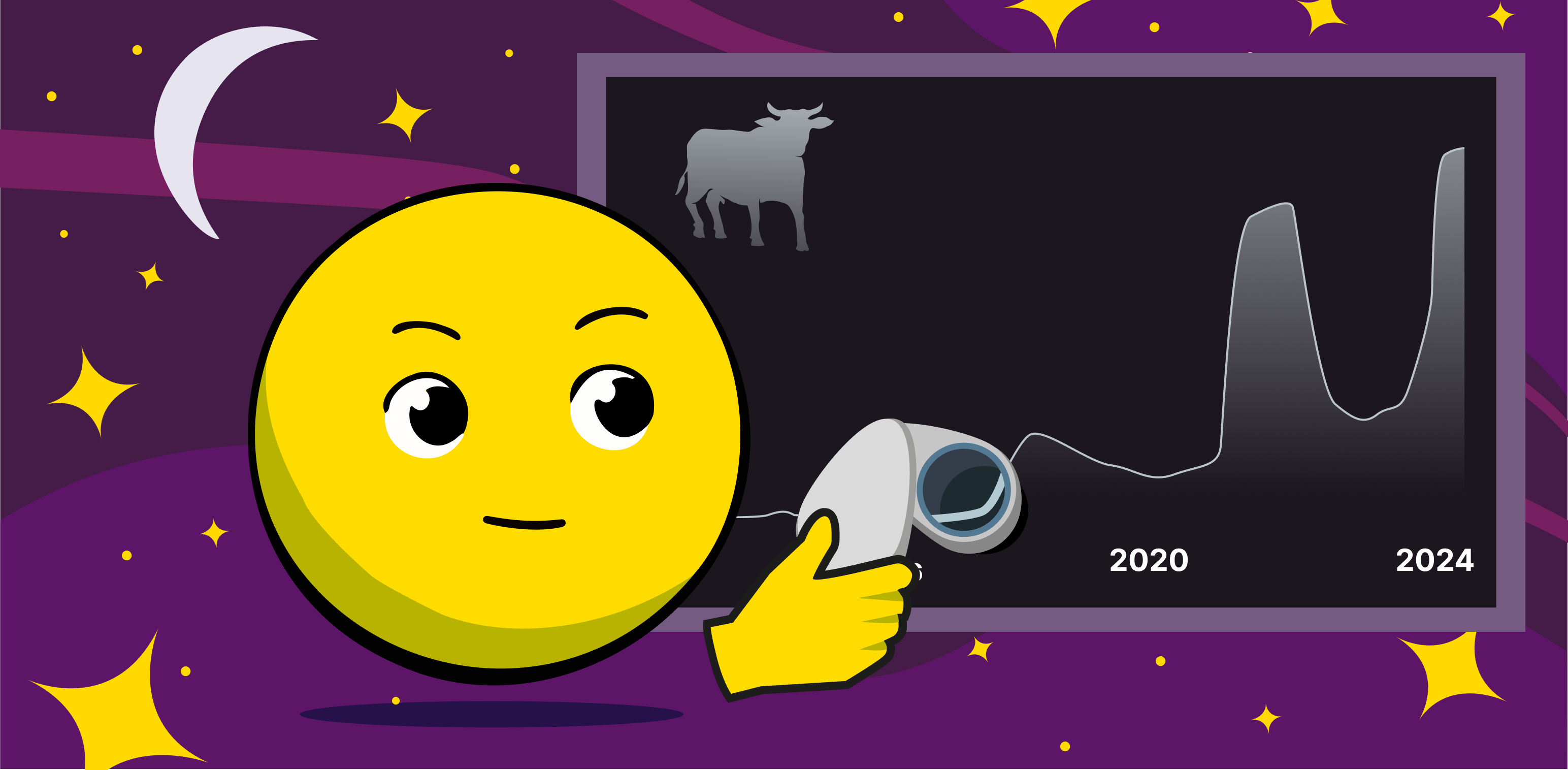

Throughout history, each halving event has been accompanied by a remarkable surge in the price of Bitcoin, both leading up to and following the event.

For instance, following the halving on Nov. 28, 2012, which saw the block reward decrease from 50 BTC to 25 BTC, Bitcoin prices skyrocketed by an astounding 8,447% over the subsequent 365 days.

Similarly, after the halving on July 9, 2016, which reduced the block reward to 12.5 BTC, Bitcoin prices experienced a more moderate yet still impressive increase of 283% in the year following the event.

More recently, following the halving on May 11, 2020, where the block reward was halved to 6.25 BTC per block, Bitcoin prices surged by a remarkable 527% in the 12 months that ensued.

The Upcoming Bitcoin Halving 2024

Market preparedness

The imminent halving event presents both challenges and opportunities for miners, as reflected in shifts in their behavior and the dynamics of the mining industry.

The dwindling reserves of Bitcoin held by miners, alongside intensified competition and historically high hash rates, underscore the imperative for operational efficiency and strategic adaptation within the sector.

Recent data indicates a decline in the number of Bitcoin held in wallets associated with miners, marking the lowest level since July 2021. This trend suggests that miners may be capitalizing on the recent surge in Bitcoin's price, either by depleting their inventory ahead of the halving or leveraging these assets to secure capital for upgrading equipment and enhancing mining facilities.

In previous halving cycles, the mining landscape was characterized by a scarcity of large-scale miners, with even fewer publicly traded entities. The upcoming halving may catalyze a wave of merger and acquisition activities among mining firms, fostering industry consolidation and driving innovation in sustainable mining practices.

Furthermore, the recent surge in retail demand can be partly attributed to the emergence of Bitcoin-based tokens like Ordinals BRC-20. These tokens, often likened to "NFTs for Bitcoin," have the potential to reshape the cryptocurrency landscape by driving on-chain activity and increasing transaction fees. This, in turn, could bolster miners' revenue streams amid declining block rewards post-halving.

Potential outcomes

The potential impact of the upcoming halving on Bitcoin's price remains uncertain. While some analysts anticipate a trajectory akin to previous halvings, characterized by post-event price surges due to reduced coin supply, the actual outcome hinges on the interplay between supply constraints and demand dynamics.

It's important to recognize that any price movement following the halving is contingent upon the evolution of demand for Bitcoin throughout the halving period. Unlike previous instances, the cryptocurrency market has undergone substantial maturation since the 2020 halving, with a proliferation of well-established alternatives vying for user adoption. As such, the trajectory of Bitcoin's price will be influenced by the relative strength of demand in this increasingly competitive landscape.

Expert insights

The diminished supply of bitcoins often serves as a catalyst for price surges, particularly during the breakout phases that typically follow a halving event. These breakout phases unfold in three distinct stages: breakout, distribution, and accumulation. During periods of limited supply coupled with sustained demand, prices tend to escalate as existing bitcoins become more valuable. Furthermore, the scarcity of supply not only accentuates the appeal of Bitcoin itself but also attracts greater capital inflows into the broader asset class.

Industry experts assert that these cyclical patterns not only drive price movements but also foster investor aspirations, as they navigate the opportunities presented by Bitcoin halving periods.

Approaching the April 2024 halving event, investors should brace themselves for heightened volatility, potential shifts in the mining landscape, and significant ripple effects across the broader cryptocurrency market:

- Heightened volatility: Historical data indicates that Bitcoin often experiences substantial price fluctuations during halving years. While these movements have traditionally skewed towards the upside, there remains the possibility of unexpected downward swings.

- Consolidation in the mining industry: With reduced block rewards, less-efficient miners may find it increasingly challenging to sustain profitability, potentially leading to a consolidation within the Bitcoin mining sector. Some miners may opt to cease operations altogether in response to diminished returns.

- Potential for price surges in alternative cryptocurrencies: While the halving specifically affects Bitcoin, other cryptocurrencies have historically demonstrated significant price movements during halving years as well. For instance, Ether, which typically maintains a strong correlation with Bitcoin prices, experienced a notable surge from $129.63 to $737.80 during the 2020 halving, marking a remarkable 469% increase. Investors should remain vigilant of such opportunities across the broader cryptocurrency landscape.

Conclusion

As we stand on the brink of the fourth Bitcoin halving, the cryptocurrency landscape brims with anticipation and uncertainty. While historical precedents offer insights into potential outcomes, the evolving dynamics of the market necessitate vigilance and adaptability. The halving event not only underscores Bitcoin's deflationary nature but also catalyzes transformative shifts within the mining industry.

Investors, miners, and enthusiasts alike must navigate this juncture with a nuanced understanding of the interplay between supply constraints, demand dynamics, and technological innovations. While challenges abound, so too do opportunities for innovation, consolidation, and value creation. As the countdown to the April 2024 halving commences, the cryptocurrency community braces itself for another chapter in Bitcoin's remarkable journey.