Users of the Multichain (MULTI) cross-chain protocol have been reporting issues with transactions getting stuck in the blockchain as a result of an error that occurred during a recent network update.

Several Multichain users have complained that their funds have been stuck in the protocol for 72 hours. Part of the problem appears to be related to updating the server, which the team says takes longer than usual.

Multichain Token fell more than 20% following reports of user funds being trapped.

The problem arose on May 21. The project team reported encountering difficulties during the technical work on cross-chain nodes.

There were also rumors about the arrest of the Multichain team, but these rumors were not confirmed.

According to an operational update provided on May 23rd, Multichain reported:

"The upgrade of the internal node is taking longer than expected." Most routes are functioning normally, although some routes (Kava, zkSync, and Polygon zkEVM) are currently suspended. All transactions that are affected will appear after the upgrade is complete.

According to a statement on the Telegram channel, as of May 24, there was only one problematic node, while the remaining six were functioning normally. Multichain assures that all user funds are safe.

According to Coingecko, the cost of the MULTI coin fell from 7.09 to 4.42 US dollars as of May 31, 2023. A drop in the value of the token can occur as a result of panic selling by holders.

Suspicious Transactions

Meanwhile, Lookonchain analysts have identified several organizations that in recent days have been involved in the potential sale of Multichain tokens on both centralized and decentralized exchanges.

One noteworthy transaction included an address from which 494,200 tokens worth $2.75 million were sent to the exchange Gate.io. In addition, Lookonchain discovered another transaction from an address registered under the Ethereum Name Service (ENS) as "hwg.eth." Yesterday alone, this man sold 36,200 tokens worth pf-word suggestion00,000. Additionally, the Fantom Foundation removed 450,000 tokens ($2.4 million) from liquidity on the decentralized exchange SushiSwap.

Amid reports of delayed transactions and falling token prices, rumors have circulated that the Chinese authorities arrested the Multichain project team and seized control of contract funds worth more than $1 billion.

What Is Multichain?

On July 20, 2020, Anyswap (ANY cryptocurrency) was launched - a decentralized cross-chain protocol designed for exchanging digital assets (tokens). The team behind Anyswap/Multichain is an international group primarily composed of Chinese experts.

In March 2022, the Anyswap platform underwent a rebranding and is now known as Multichain (MULTI cryptocurrency).

The name change is linked to a substantial increase in the platform's capacity following the integration of a new component, known as the router (further details provided below).

Multichain (MULTI) Features

Multichain is one of the well-known platforms in the field of decentralized financing (DeFi), used for the swapping (exchange) of tokens, staking and trading.

The platform allows you to perform operations without intermediaries and extra costs for converting digital assets between dozens of different blockchains, having more than 2460 supported tokens.

The main task of the platform is to ensure mutual compatibility between different blockchains.

Thanks to this, Multichain supports both EVM-compatible networks (Ethereum, BSC, Fantom, Arbitrum, Polygon, Avax, Moonbeam and others), as well as Non-EVM-compatible networks (Bitcoin, Litecoin, Polkadot, Tosmos, etc.).

About Cryptocurrencies Anyswap (token ANY) and Multichain (MULTI)

MULTI is the native token of the Multichain project. In addition to being used as a means of payment, it serves to manage (Governance) the holders of the ecosystem and to pay them a reward (45% of the fees received for exchange transactions are distributed between them).

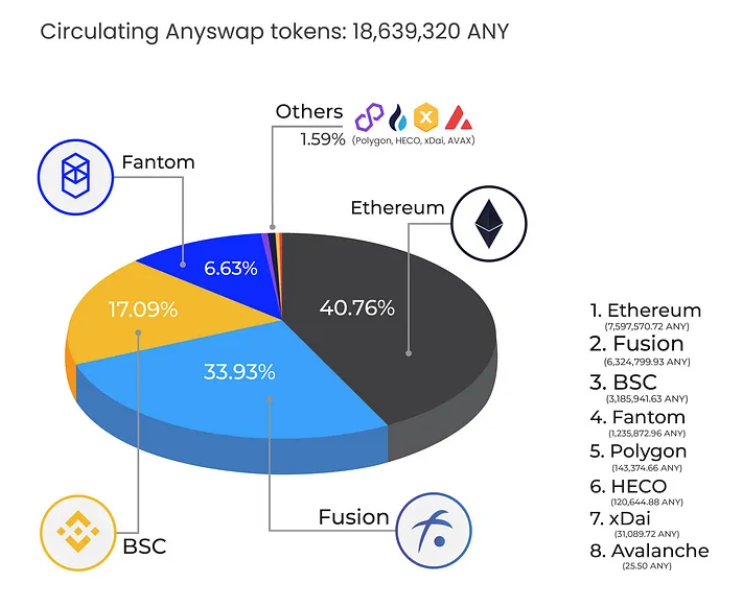

Latest ANY Tokenomics

- ANY Total supply: 100,000,000

- ANY Circulating supply: 18,639,320

Investors Are Remaining Calm Despite Rumors

According to a Twitter thread by the crypto researcher DeFi Ignas, Fantom (FTM) is the most exposed to Multichain’s wrapped tokens. This suggests that Fantom is particularly vulnerable to any negative impact that may result from the rumored arrest of the Multichain team. This is because Fantom has significant exposure to Multichain’s wrapped tokens, with 35% of its total value locked (TVL) dependent on these wrappers.

Ignas predicted that there would be a significant outflow of Total Value Locked (TVL) from Fantom due to its reliance on Multichain, but data shows only 1% was withdrawn from its TVL of $1.78 billion, indicating little panic in the market.

Although TVL has dropped by 9.55% in USD, adjusting for the FTM price reveals no significant capital outflow. The only sign of panic is seen among Multichain Liquidity Providers (LPs) on Fantom with $33 million being withdrawn and just $1.7 million deposited.

However, investors are concerned about the lack of communication from the Multichain team as CEO Zhaojun hasn't been online for a week leaving many feeling uncertain about the project's future prospects.

In Conclusion

The recent situation with Multichain (MULTI) has been challenging for the project and its investors. The reported issue with Multichain transactions hanging in the blockchain due to a network update error has caused inconvenience and frustration for some users. Additionally, the panic sales that followed the news about the MULTI token.

However, it is important to note that Multichain has taken swift action to address the issue, releasing a patch to fix the error and providing instructions for users on how to resolve any issues with their transactions.

While the situation has been difficult, the team's response demonstrates their commitment to their users and to the ongoing development of the project. As the issue is resolved and confidence in the protocol is restored, it is possible that the price of the MULTI token may recover.

Despite the challenging circumstances, the team's response showcases their dedication to their users and the continuous advancement of the project. As the issue is resolved and confidence in the protocol is restored, the value of the MULTI token may rebound.