Buy Chainlink with a credit card

You can buy LINK for USD and other fiat currencies here at SwapSpace! We provide an easy way to do that via one of our partners, such as Mercuryo, Guardarian, or Simplex, with a few simple steps right on this page. You can also look at Chainlink price dynamics and history, get some answers to your questions, and find some useful links to read more about what is LINK.

Chainlink live price chart

LINK price can be volatile. You can see the history of price changes in the cryptocurrency price chart below to help you make the best decision while considering buying crypto.

Chainlink is a decentralized oracle network and cryptocurrency that aims to bridge the gap between smart contracts on blockchain platforms and real-world data, APIs, and external systems. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. While they work well for transactions and processes that occur entirely on a blockchain, they lack the ability to access and interact with data outside of the blockchain.

Chainlink was founded by Sergey Nazarov and Steve Ellis. Sergey Nazarov is the CEO of Chainlink, and Steve Ellis is the co-founder. They founded the project to address a critical limitation of smart contracts on blockchain platforms: the inability to interact with external data and systems in a trustless and decentralized manner.

Chainlink was officially announced in September 2017, and its initial coin offering (ICO) took place later that year. The project gained traction and attention in the blockchain and cryptocurrency space due to its innovative approach to solving the oracle problem. The "oracle problem" refers to the challenge of obtaining reliable, real-world data and securely integrating it with smart contracts, which are deterministic and operate on a blockchain.

Chainlink connects to various blockchains and operates as a middleware layer to provide external data to smart contracts on those blockchains. The consensus mechanism used by Chainlink depends on the blockchain to which it is providing oracle services. Chainlink can integrate with multiple blockchains, and each of these blockchains may have its own consensus mechanism.

For example, Chainlink has a strong presence on the Ethereum blockchain, where it provides oracle services to Ethereum smart contracts. Ethereum primarily uses the Proof of Stake (PoS) consensus mechanism in its transition to Ethereum 2.0, although it previously used Proof of Work (PoW).

On Binance Smart Chain, Chainlink oracles support smart contracts. BSC uses a variant of the Tendermint Byzantine Fault Tolerance (BFT) consensus mechanism. Chainlink has expanded its services to support various other blockchains, including Polkadot, Tezos, and more. These blockchains may have their own consensus mechanisms.

Chainlink provides a solution to this limitation by enabling smart contracts to securely and reliably interact with data sources and external systems, making them more versatile and capable of executing a wide range of applications.

Chainlink's founders recognized that for smart contracts to have real-world utility and be applied to a wide range of use cases, they needed a secure and decentralized way to access off-chain data. This led to the development of the Chainlink network, which connects smart contracts with external data sources, APIs, and various off-chain systems through a decentralized network of oracles.

Various data providers, such as API providers, weather services, financial market data providers, and more, participate in the Chainlink network. They supply real-world data to the oracles. Smart contract developers can request specific data or computations through Chainlink's network of oracles. They specify the data they need and the conditions under which the data should be retrieved and transmitted to the smart contract.

Oracle nodes within the Chainlink network fetch and verify the requested data from the data providers. They then transmit this data to the smart contract on the blockchain. Chainlink's design emphasizes decentralization and security. Multiple oracle nodes provide the same data, and the smart contract can use various algorithms to verify the accuracy of the data. This redundancy and security mechanisms help ensure the reliability of the data.

Through its extensive network of node operators, Chainlink collaboratively supports numerous decentralized Price Feed oracle networks that are actively operational. These oracle networks play a pivotal role in safeguarding billions of dollars in value for prominent DeFi applications, including but not limited to Synthetix, Aave, Compound, and many others.

The native cryptocurrency of the Chainlink network is called LINK. LINK is used as a means of payment for oracle services within the network and can also be used to incentivize oracle node operators. It plays a crucial role in the ecosystem's functioning.

Those who hold LINK tokens and choose not to operate their own node have the option to engage in staking by delegating their tokens to a reputable node operator. According to Chainlink developers, the staking initiative is expected to provide an initial return of 5%. This return is a combination of emissions from the Treasury and fees collected from users of Chainlink's data feeds. In the long run, the staking program will become self-sustaining, relying solely on the fees generated by the network.

In December of last year, Chainlink introduced its initial beta version of Chainlink Staking (v0.1). This version featured a staking pool of 25 million LINK tokens, primarily designed to enhance the security of the ETH/USD Data Feed on the Ethereum blockchain. Participants, including Community Stakers and Node Operator Stakers, were eligible to earn staking rewards by contributing to a decentralized alerting system that focused on meeting performance requirements.

Looking ahead, the next iteration of Chainlink Staking (v0.2) is set to launch later this year in the fourth quarter. The upgraded version will start with an expanded pool of 45 million LINK tokens. The release of the v0.2 beta will progressively open access to a wider range of participants. It will begin with a Priority Migration phase for existing v0.1 stakers, followed by an Early Access stage, and ultimately General Access for all interested parties.

LINK token has a total supply of 1 billion. As outlined in the ICO documentation, 35% of the overall token supply is allocated for supporting node operators and fostering ecosystem growth. An additional 35% of LINK tokens were distributed through public sale events. Lastly, the remaining 30% of the total token supply was earmarked for the company to sustain ongoing development efforts within the Chainlink ecosystem and network.

As of September 21, 2023 LINK has a circulating supply of 556,849,970 tokens.

Chainlink has gained significant attention and adoption in the blockchain and cryptocurrency space due to its ability to enable smart contracts to interact with external data and systems in a secure and trustless manner. This makes it particularly valuable for a wide range of applications, including decentralized finance (DeFi), supply chain management, insurance, gaming, and more.

Average Fees on the Chainlink Network

The fees on the Chainlink network are not fixed and can vary depending on several factors, including the blockchain to which Chainlink is integrated and the specific nodes or oracle services being used. Chainlink itself does not have its own native blockchain or transaction fees.

The fees associated with using Chainlink typically involve the transaction fees of the underlying blockchain, which are paid in that blockchain's native cryptocurrency (e.g., gas fees on Ethereum).

How and Where to Buy the LINK Token

Users can buy Chainlink (LINK) tokens from various cryptocurrency exchanges using fiat currency or other cryptocurrencies. To buy LINK with fiat on SwapSpace, follow the instructions below.

How to buy LINK on SwapSpace

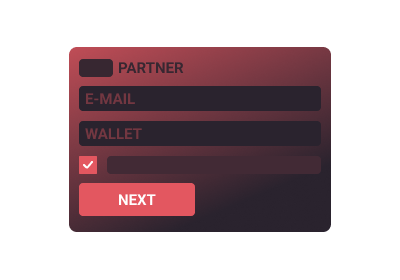

On this page, we put USD in the “You send” and LINK in the “You get” sections in the widget. USD is the default, but you can choose your preferred fiat currency. Put in the amount of fiat you want to spend. Next, press the ”View offers” button and choose a provider.

Fill in the “Enter the recipient address” field with the destination Chainlink address. Check the information carefully and click the “Next” button. After reading the special terms and conditions in the next window, click “Next” again.

At this point, you will either see our partner’s widget or be redirected to another page, depending on the chosen provider. You will be asked to verify your identity, as this is standard practice for the services that work with fiat money. Follow the provider’s instructions on the screen.

After completing the KYC procedure, fill in your credit card information. At this point, everything is in place and your transaction will start.

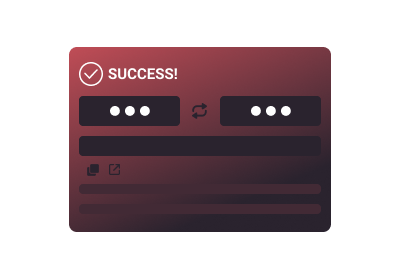

Wait for the transaction to process. You’ll see a message when it’s completed. A window with your transaction details will also appear; from there, you can also create another crypto-fiat exchange.

Frequently asked questions

Is there a way to predict Chainlink (Arbitrum One) future price?

Is there a way to predict Chainlink future price?

Are there limits for buying Chainlink?

Can I purchase LINK with other crypto instead of fiat?

Curious for more?

Join our newsletter — stay informed, stay empowered.