Buy FTX Token with a credit card

You can buy FTT for USD and other fiat currencies here at SwapSpace! We provide an easy way to do that via one of our partners, such as Mercuryo, Guardarian, or Simplex, with a few simple steps right on this page. You can also look at FTX Token price dynamics and history, get some answers to your questions, and find some useful links to read more about what is FTT.

FTX Token live price chart

FTT price can be volatile. You can see the history of price changes in the cryptocurrency price chart below to help you make the best decision while considering buying crypto.

Here you can see the current FTT price, as well as the FTT price history.

What is FTT?

FTX was a leading cryptocurrency exchange and trading platform that allowed users to trade a variety of digital assets, including cryptocurrencies, tokens, and other derivatives. The platform is known for offering a wide range of trading products, including spot trading, futures trading, options trading, tokenized stocks, prediction markets, and more.

FTX was founded by Sam Bankman-Fried and Gary Wang. Sam Bankman-Fried is a well-known figure in the cryptocurrency industry and is the CEO of FTX. Gary Wang, his business partner, has played a significant role in the development of the FTX platform as well.

Sam Bankman-Fried, a former quantitative trader, and Gary Wang started FTX in 2019 with the goal of creating a comprehensive cryptocurrency trading platform that offers a wide range of trading products. They aimed to address some of the limitations and challenges faced by traders on existing exchanges, such as lack of liquidity, a limited variety of trading pairs, and complex user interfaces.

Sam Bankman-Fried, in particular, has become a prominent figure in the cryptocurrency space, known not only for his role at FTX but also for his involvement in various industry discussions and initiatives. FTX has continued to grow and expand its offerings since its founding, becoming one of the leading cryptocurrency exchanges in terms of trading volume and user activity.

FTX was officially launched in May 2019. The founders saw an opportunity to improve the cryptocurrency trading experience and provide a platform that caters to both retail and institutional traders. They aimed to create a robust and feature-rich exchange that could meet the evolving needs of the cryptocurrency community. FTX was conceived with the vision of creating a comprehensive cryptocurrency trading platform that caters to the needs of both retail and institutional traders. The goal was to offer a wide range of trading products beyond simple spot trading.

FTX differentiated itself by introducing innovative features such as tokenized stocks, prediction markets, and a variety of derivative products. Tokenized stocks, in particular, allowed users to trade traditional stocks in a tokenized form on the blockchain.

FTX actively pursued partnerships and collaborations to enhance its ecosystem. This included collaborations with other cryptocurrency projects, influencers, and industry leaders.FTX placed an emphasis on building a strong community around its platform. Engaging with the cryptocurrency community through social media, events, and educational initiatives helped raise awareness about FTX and attract users.

Leveraged tokens on FTX are a unique financial instrument designed to provide traders with leveraged exposure to cryptocurrency markets without the need to manage margin positions or liquidation risks manually. FTX offers a variety of leveraged tokens, and they are denominated in the underlying asset's token.

Leveraged tokens on FTX are structured to provide a certain leverage level, such as 3x or -1x (inverse). For example, if you have a 3x leveraged long Bitcoin token, it aims to move three times the percentage of Bitcoin's price movement.

The leveraged tokens automatically rebalance their positions to maintain the target leverage. This means that if the underlying asset's price moves, the leveraged token will adjust its position to maintain the specified leverage. Leveraged tokens have an automatic liquidation mechanism to protect traders from losing their entire investment. If the price of the underlying asset moves against the leveraged token position to a certain threshold, the token is automatically liquidated, and investors may experience losses.

FTX Exchange launched FTT, its native ERC-20 token, a year after its inception. Originally a reward for transactions, FTT's uses expanded over time. It's employed in creating leveraged tokens, grants VIP discounts based on holdings, and rewards liquidity provision in futures positions.

FTT can be used as collateral for trading on FTX, allowing users to leverage their holdings for additional trading opportunities. FTX uses a unique model where gains and losses from clawbacks (situations where a position is liquidated and the losses are socialized across the platform) are distributed among FTT holders, providing an additional incentive for holding the token.

To sustain its value, FTX regularly buys back and burns FTT using a portion of trading fees, reserve funds, and other commissions. FTT use cases include buybacks with transaction commissions, reducing trading fees, securing futures positions, distributing profits to holders, and facilitating institutional transactions. FTT staking brings additional perks like discounts, NFT opportunities, participation in airdrops, bonus votes, and IEO tickets, making FTT versatile for various benefits on the FTX Exchange.

FTX has gained popularity for its innovative products, user-friendly interface, and active community.

In early November 2022, FTX faced a collapse following a CoinDesk report linking its affiliated trading firm, Alameda Research, to most of its value being derived from speculative cryptocurrency tokens. The revelation led to a surge in customer withdrawals due to concerns about questionable financial practices and an unusually close relationship with Alameda. This series of events pushed both FTX and Alameda into bankruptcy, causing significant turmoil in the crypto market, resulting in losses of billions and a valuation drop below $1 trillion.

By December 2022, the U.S. government responded with civil and criminal charges against Sam Bankman-Fried and top executives. The charges included misappropriating over $8 billion in customer deposits, laying the groundwork for insolvency, and generating false financial statements inflated with niche token holdings to mask the financial shortfall.

Sam Bankman-Fried faced trial in October 2023 and was convicted in November 2023 on criminal charges. He was extradited from The Bahamas to the U.S., with one charge dropped in July 2023. A second trial is scheduled for March 2024, involving charges filed after his extradition.

The fallout from FTX's collapse extended beyond its own demise, affecting other major cryptocurrency services that had established risky financial arrangements with FTX and Alameda. These services faced regulatory scrutiny and financial challenges as a result of their connections to the troubled entities.

FTX's website is presently inactive, signaling a period of dormancy. However, discussions about a potential restructuring and resurgence under new ownership are underway. Three interested parties are actively bidding to assume control and revitalize the exchange. The process of seeking new ownership started as early as June 2023.

As a result of the legal challenges and court cases involving FTX and its founder Sam Bankman-Fried, the FTT token faced delisting from several exchanges, including notable platforms like Binance. Delisting typically occurs when an exchange decides to remove a particular token from its trading pairs due to regulatory concerns, legal issues, or other risk factors associated with the token or its issuer. This action can impact the liquidity and availability of the token for trading on those platforms.

The Average Fees on FTT

FTX typically employs a tiered fee structure, where the trading fees vary based on factors such as the user's trading volume and whether they hold FTT (FTX's native token). Holding FTT often provides users with fee discounts.

The gas fees associated with transactions on FTX, especially for deposits and withdrawals of Ethereum-based assets, depend on the Ethereum network. Gas fees on the Ethereum network can vary based on network congestion and the level of activity at any given time

The FTT Token Wallets

Despite being delisted from numerous exchanges, the FTT token can be still held in many crypto wallets, including Ledger, MetaMask, Trust Wallet, Atomic Wallet, Coin98, Coinhub, Coinomi, Edge, etc.

How to buy FTT on SwapSpace

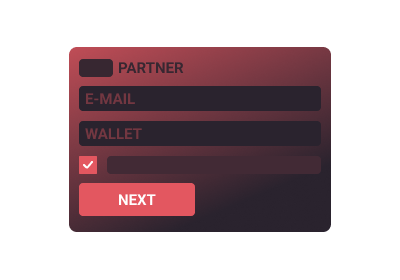

On this page, we put USD in the “You send” and FTT in the “You get” sections in the widget. USD is the default, but you can choose your preferred fiat currency. Put in the amount of fiat you want to spend. Next, press the ”View offers” button and choose a provider.

Fill in the “Enter the recipient address” field with the destination FTX Token address. Check the information carefully and click the “Next” button. After reading the special terms and conditions in the next window, click “Next” again.

At this point, you will either see our partner’s widget or be redirected to another page, depending on the chosen provider. You will be asked to verify your identity, as this is standard practice for the services that work with fiat money. Follow the provider’s instructions on the screen.

After completing the KYC procedure, fill in your credit card information. At this point, everything is in place and your transaction will start.

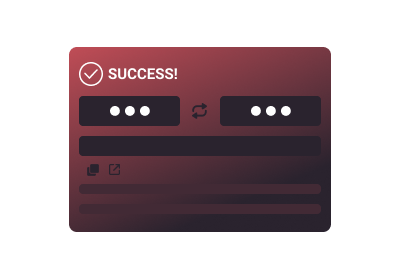

Wait for the transaction to process. You’ll see a message when it’s completed. A window with your transaction details will also appear; from there, you can also create another crypto-fiat exchange.

Frequently asked questions

Is there a way to predict FTX Token future price?

Are there limits for buying FTX Token?

Can I purchase FTT with other crypto instead of fiat?

Other popular crypto to buy now

Changed your mind about buying ftt? Think that another coin is the best crypto to buy now? Take a look at other offers! Or you can exchange crypto-to-crypto.

Curious for more?

Join our newsletter — stay informed, stay empowered.