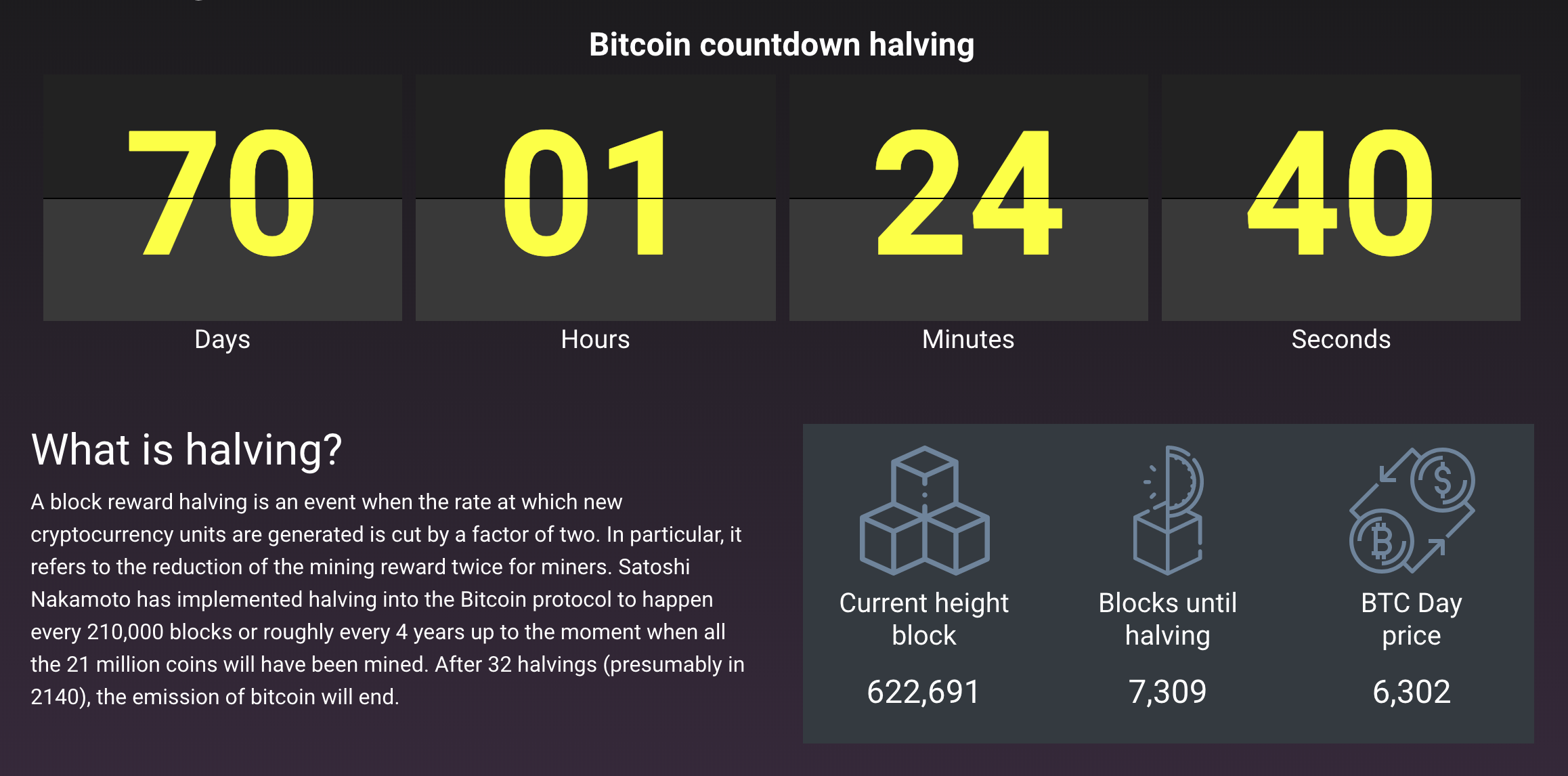

By now, Bitcoin is a word that most of the people on this planet have heard before. It has transformed from being an exclusive innovation for a select group of people to sparking true revolutions in developing countries. One of the main factors of Bitcoin being so special is the scarcity of the asset. There can only be 21 million Bitcoins to ever be mined. The protocol is built in a way that every 210,000 blocks the reward for mining Bitcoin is cut in half. In practice, this happens approximately every four years. At this point, the mining rewards sit at 12.5 Bitcoin per block. The upcoming Bitcoin halving is expected to occur around the 12th of May 2020, when the BTC mining reward will be reduced to 6.25 Bitcoin per block. What does that mean for the future of Bitcoin and how will this affect the price? Let’s look at a few factors and analyze the possible outcomes.

Increased Bitcoin scarcity

One clear fact is increased scarcity. Right now, there are around 980 Bitcoins that are produced every single day. When that number is cut in half, it becomes more unique to own Bitcoin as the asset becomes more scarce. This is one of the main reasons people compare Bitcoin to gold. Whenever it becomes evident the gold supply is running low and there’s less available in the ground than before, gold becomes more scarce and the interest grows. It’s embedded within human nature to react to scarcity and feel the urge to possess the scarce asset. We’ve seen it happen before with gold and possibly the same will happen with Bitcoin. After the Bitcoin halving, it will become more difficult to own Bitcoin. It will play into the fear of missing out (FOMO), which, in turn, plays a big role in the cryptocurrency industry.

Increase in Bitcoin mining costs

Another factor that should not be underestimated is the increase in costs for mining Bitcoin. With the current reward for BTC mining, the Bitcoin price should be above roughly $4,000 to break even for miners. Anything above that would mean the miners make a profit in comparison to the costs of mining. Note that a Bitcoin mining operation requires large initial investments with hardware, electricity costs, and logistics. When the mining reward is cut in half, it will become more expensive for new and existing miners to achieve profitability. This will incentivize the miners to pump up the price to higher levels in order to make a profit. It’s in everyone’s interest to have enough people mining Bitcoin to keep the network stable, so a higher price to keep all the miners on board would be a win-win for anyone. Of course, this does not refer to the individual with a mining rig in their garage box, it concerns the large mining pools that can be seen in the graph above. Those parties that collaboratively control a major part of the Bitcoin network. They have enough influence to impact the Bitcoin price as well.

Another factor that should not be underestimated is the increase in costs for mining Bitcoin. With the current reward for BTC mining, the Bitcoin price should be above roughly $4,000 to break even for miners. Anything above that would mean the miners make a profit in comparison to the costs of mining. Note that a Bitcoin mining operation requires large initial investments with hardware, electricity costs, and logistics. When the mining reward is cut in half, it will become more expensive for new and existing miners to achieve profitability. This will incentivize the miners to pump up the price to higher levels in order to make a profit. It’s in everyone’s interest to have enough people mining Bitcoin to keep the network stable, so a higher price to keep all the miners on board would be a win-win for anyone. Of course, this does not refer to the individual with a mining rig in their garage box, it concerns the large mining pools that can be seen in the graph above. Those parties that collaboratively control a major part of the Bitcoin network. They have enough influence to impact the Bitcoin price as well.

History repeats

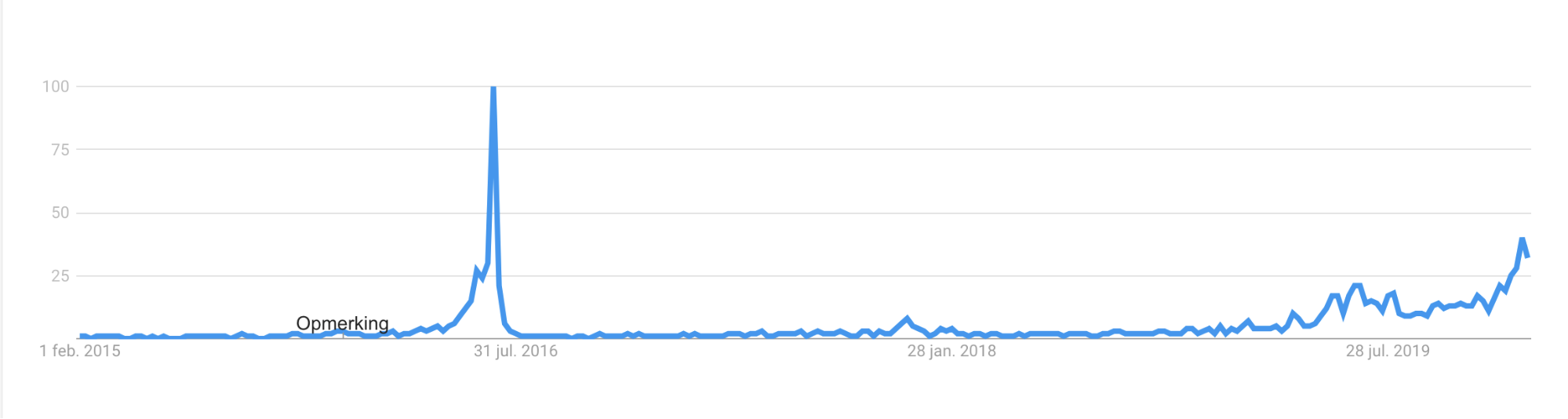

There have been two Bitcoin halvings before the one that is just around the corner. When you look at the chart above, we could just see history repeat itself. History shows that especially in the months gearing up towards the Bitcoin halving, the price is slowly increasing. After that, the price remains stagnant for a couple of months to then grow even further. Right now, we’ve seen prices slowly move up again after the lowest point of around $3,500 last year.

What are the experts saying?

We can draw a few scenarios that we see happening surrounding the Bitcoin halving, but before we do this, we would like to have a look at what the experts are saying. Anthony Pompliano, the co-founder of Morgan Creek Digital and a prominent figure in the industry, shared the following in an interview: “The halving will be a big moment for Bitcoin. I don’t think that the price will shoot up the day after it, but I do think that from the day we are right now, we will see Bitcoin’s price at $100,000 by December 2021.”Another prediction comes from the Winklevoss twins, two prominent figures in the industry that are known for being the founders of Gemini and being the original founders of what we now know as Facebook. “The halvening in May will be big for Bitcoin“, Cameron Winklevoss said. “It’s rarely priced in”. They do not call for a specific BTC price to aim for, but they are convinced we are bound for another spike in price with the upcoming Bitcoin halving.

To conclude

We are no fortune tellers and we do not want to create any illusions here, but the Bitcoin halving is an important factor in the crypto sphere as a whole. The entire industry has been discussing it for the past couple of months and will have been doing so for the upcoming months. If the Bitcoin halving already had its impact on the Bitcoin price is something we can only tell in a couple of months. One thing is for sure: Bitcoin will become more scarce. So, if you have the opportunity to do so, now is your time to benefit from the period with the current BTC mining reward. And, as always, you can use SwapSpace to exchange your coins — for example, trade your hard-earned BTC to something else. The future is looking bright for Bitcoin, are you joining that future?