Token unlocks play an important role in asset pricing, so keeping a close eye on unlock schedules will help investors better understand growth potential and tailor their strategies.

Token unlock is a release of cryptocurrencies previously blocked according to the economic model of the crypto project. These tokens can include assets intended for project developers, early adopters, and investors.

In this article, we look at how crypto unlock works and what to look for when building a business strategy.

Reasons for token locking

The crypto market has partially adopted the instruments of stock markets, describing the mechanisms, rules, and clear conditions for project teams and investors. Tokenomics became the main tool for attracting capital and entering the project on the open market.

Tokenomics is a set of rules describing the economic model of a project based on its native token, as well as clear boundaries on the issue and distribution of tokens to project participants and/or investors.

In the traditional market, these boundaries by distribution or issue of shares can be determined by the level of economic achievements of the company, and financial or production indicators. In the crypto market, the time was the most popular indicator. For example, early investors can set a vesting period (token blocking) for a period of 1 year or enable periodic unlocking of tokens, once a month for three years, for example.

Thus, when a project enters the market, the circulating supply of its tokens is often limited. For developers, It can be a period for unlocking tokens and another for investors. Thus, a token unlock schedule is formed.

Theoretically, this practice assumes that employees, investors, and early users are given a certain period of time to create demand for tokens, so as not to create pressure on the price at the start of trading. This is necessary because early participants and investors of the project receive tokens for free or at a significant discount.

For example, the cryptocurrency fund Pantera Capital in May 2024 bought Toncoin (TON) for 60% of its market price. However, the fund has a one-year restriction on access to tokens (vesting), after which the company can withdraw coins in batches for several years.

Influence on market dynamics and possible outcomes of token unlocks

Token unlocks significantly affect cryptocurrency prices, volatility, and overall market dynamics. Therefore, tracking changes in the supply of an asset — from large-scale airdrops to barely noticeable linear unlocks — is extremely important for investors.

Unlocks can be divided into linear and cliff splits, each has its features:

- Linear unlocks increase the turnover supply gradually, over a certain period. The most famous example is the reward of miners in the Bitcoin network, which is slowly increasing the number of available BTCs.

- Cliff unlocks involve unlocking a large amount of tokens at the same time. This can lead to significant price fluctuations as investors decide whether to hold or sell their coins.

However, these unlocking schemes are of less importance than the following factors. Before building a market strategy, it is advised to understand how token unlock will affect the balance of supply and demand of the particular cryptocurrency. To do this, it is necessary to understand who owns the locked assets:

- Only funds. The coins may not be sold if at the moment the price is not very different from the price at which funds received them.

- Private investors > funds. Most of the tokens will be immediately sold to the market. This will increase supply, and demand will remain at the same level.

- Private investors < funds. The private investors’ tokens will be bought by large funds just after their sale. Thus, the balance of supply and demand will not change as well as the price.

Key factors affecting price

General market trends play a more significant role in determining the direction of price movement.

- Positive sentiment can lead to higher prices, while negative sentiment can cause declines.

- Prevailing market conditions may increase or mitigate the impact of crypto unlocking on prices. Therefore, it is also important to know the percentage of the total volume of the already available supply. When that percentage is small, the erosion of market capitalization can be significant.

- Speculation and news also play a role. It can contribute to price volatility during the unlock period.

Case studies on crypto unlock: comparison of token unlocking effects

For clarity, let's consider several examples of large breakdowns presented by analysts at cryptorank.io. Token unlocks are presented as a percentage of capitalization. Experts distinguish two main scenarios for the price action after a major token unlock: the “Dump and Pump” and the “Pump and Dump” effects.

Dump and Pump

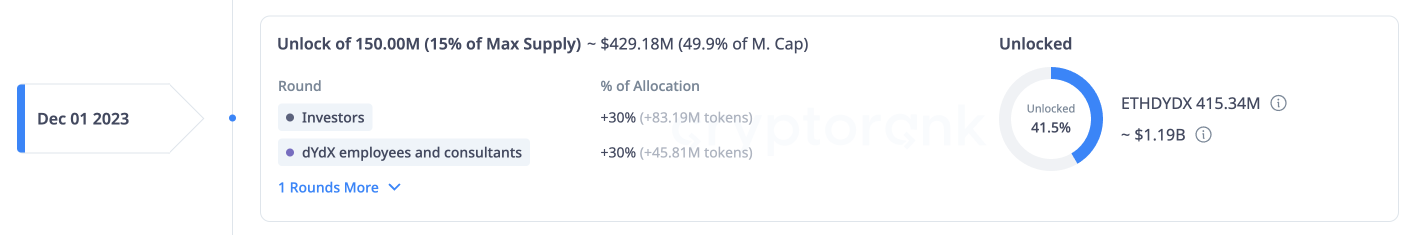

For example, in December 2023, 15% of the maximum offer of DYDX was unlocked (47.7% of the market value). The chart shows rate pressure on the release date, December 1, when the cost plummeted to $2.7. However, the next day there was a short compression, and the price pumped to $3.2, increasing by more than 15%.

A month earlier, dYdX had announced changes in tokenomics and the launch of an Alpha Mainnet in Cosmos. Thus DYDX became the native token for all transaction payments. Combined with the bullish sentiment, this caused a doubling of the rate. After all the news was published, the price began to fall. Without this information, the tokens’ value could behave differently during unlocking.

It indicates that many market participants considered it obvious that the price would fall due to a large unlocking, and they relied on this assumption. The stop of news about the unlock reinforced the result. When too many short positions accumulated, a sharp buyback followed, eliminating the shorts. In the market, obvious things often turn out to be a trap.

Pump and Dump

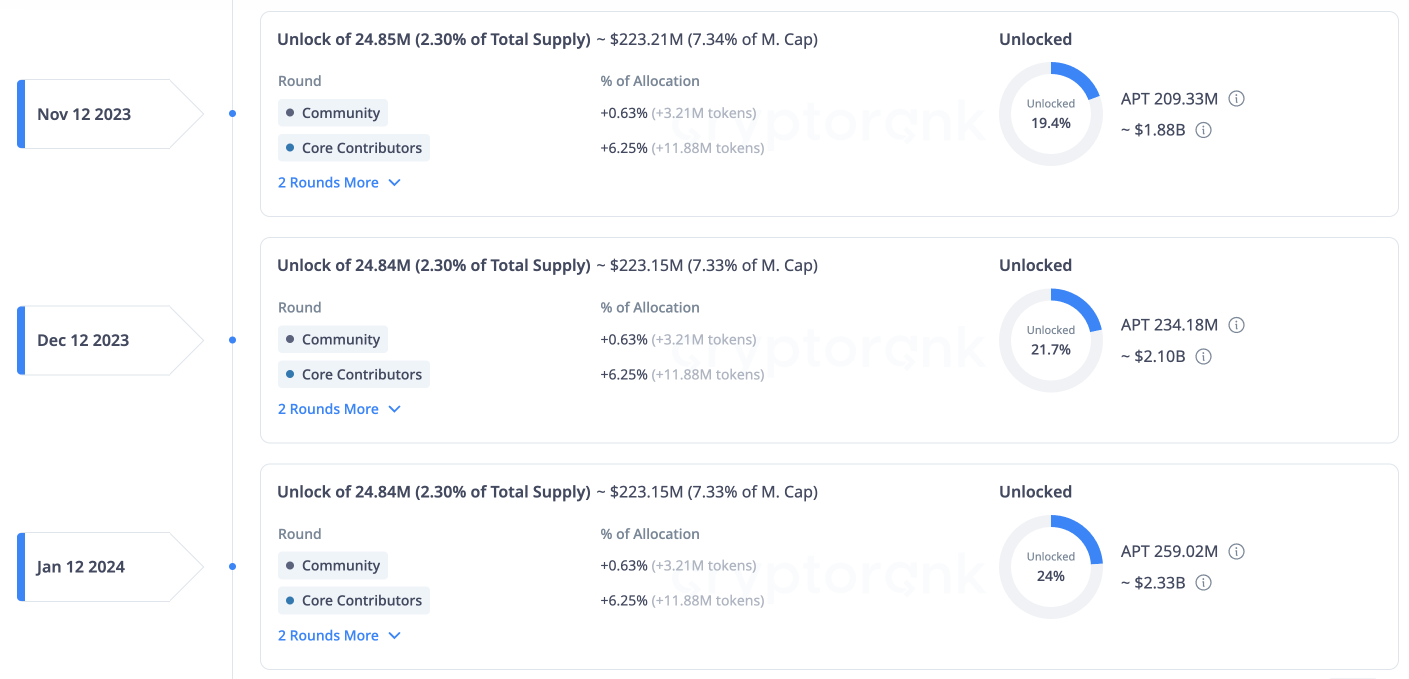

An example of such a scenario is Aptos. Within a month, the project conducted three major APT token unlocks. In this case, major ecosystem updates did not affect the asset’s price. All three unlocks have a similar cost action: a few days before the split, the rate is at local lows, and shorts are closed before the expected increase.

Then you can observe the rise of price, where the culmination of the growth is the unlocking itself. The third token split scenario was disrupted by a large drop in the Bitcoin line due to news of ETF approval. APT fell following BTC. Otherwise, one would expect a repetition of the previous scenario.

Conclusion

Understanding token unlocks is essential for navigating the volatile cryptocurrency market. You can make more informed decisions and anticipate potential price movements by analyzing unlock schedules, investor behavior, and market sentiment. While token unlocks can lead to significant fluctuations, they also present opportunities for strategic investment. Keeping track of these events can help you better manage risks and maximize returns in the dynamic world of crypto investing.