It’s no secret that some cryptocurrencies have a significant carbon footprint and consume the same amount of energy annually as individual mid-sized countries such as Spain, Sweden, or Austria. The excessive energy consumption associated with crypto-assets operations poses significant hurdles to their widespread adoption. In this article, we will delve into the numbers surrounding this issue and explore potential solutions.

Consumption and emissions

The energy usage level of cryptocurrencies has become a pressing concern. By 2023, published estimates of the total global electricity consumption for crypto-assets show the amount between 120 and 240 billion kilowatt-hours per year.

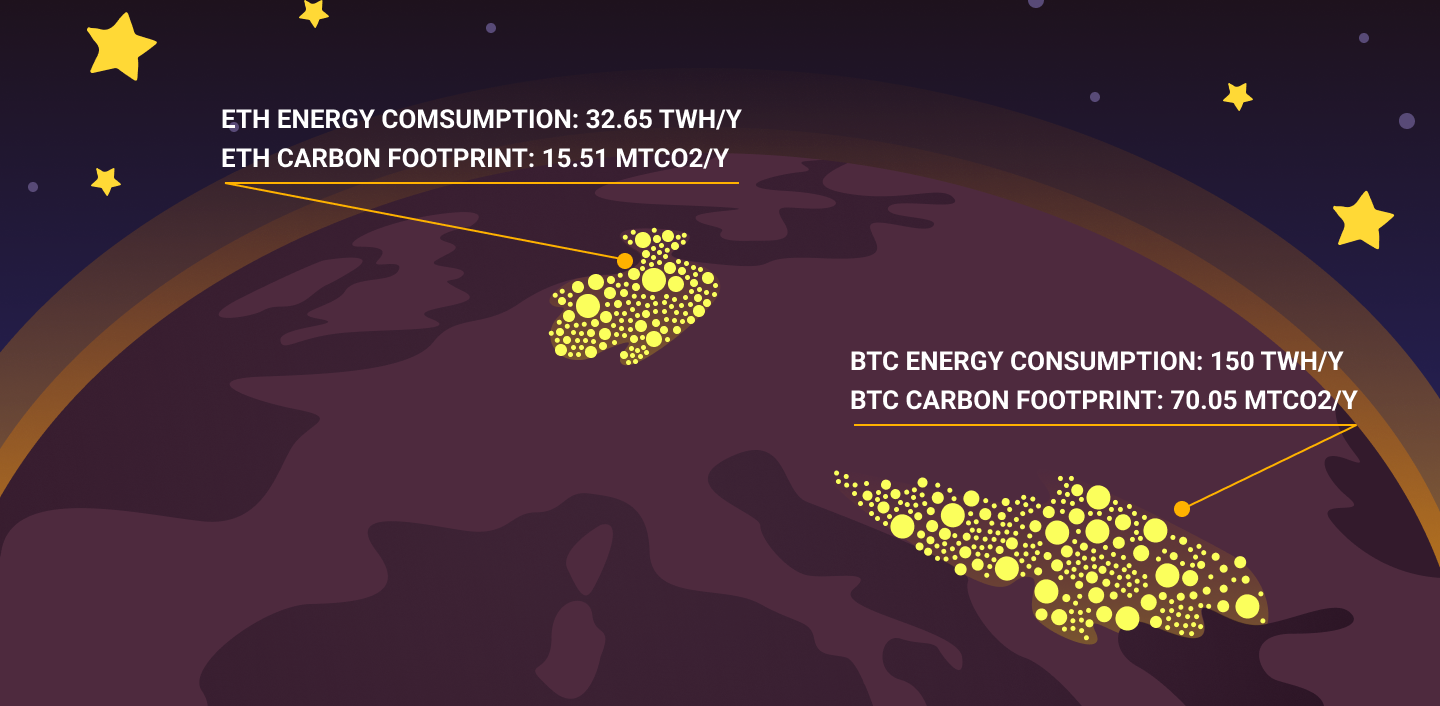

Bitcoin, being the largest cryptocurrency, has attracted criticism for its high carbon emissions. BTC currently consumes an estimated 150 terawatt-hours of electricity annually and has an emission in the amount of 70.05 MtCO2 a year. This is more than the annual electricity consumption in Sweden (124.6 TWh), Netherlands (117 TWh), and Argentina (129 TWh), and the carbon footprint of Serbia and Montenegro together (63.64 MtCO2/yr).

The second most capitalized cryptocurrency, Ethereum, while being on the original proof-of-work consensus mechanism, consumed 32.65 TWh per year, comparable to the entire energy consumption of Serbia. Ethereum's carbon footprint was estimated at 15.51 megatons of CO2, similar to Lithuania's one.

The energy-intensive Proof-of-Work (PoW) process contributes to these emissions, exacerbating the environmental concerns.

PoW consumption vs. PoS

Many cryptocurrencies are moving towards a Proof-of-Stake (PoS) consensus mechanism, as it is considered a way to address the energy consumption and emissions issue. Let’s take a look at how both PoW and PoS mechanisms work.

Proof-of-Work requires network validators to solve a mathematical problem in order to become the designated entity responsible for the validation of the latest block. Miners solve this complex mathematical puzzle related to the block using computational power. Since the puzzle is computationally challenging, miners need to perform multiple hash computations by varying the nonce until they find a solution that meets the predefined criteria. A raw calculating power is needed to run these algorithms which can be produced only with the help of the extensive networks of high-powered computers that, in turn, require the cooling system for the hardware itself. These use a tremendous amount of energy.

Unlike PoW, which relies on computational power to solve a mathematical problem, Proof-of-Stake allocates the right to create new blocks and validate transactions based on participants’ stake or ownership of cryptocurrency. Thus, instead of performing cryptographic hashing, each node just needs to prove it has enough coins staked in it, which significantly reduces energy usage and carbon emissions.

Ethereum with its transition from PoW to PoS, known as "the Merge", executed on September 15, 2022, has shown astonishing results, reducing energy consumption by ~99.95%.

Current Ethereum energy consumption is 0.02 TWh, comparable to the power consumption of Gibraltar with a population of around 32 000 people, and the current carbon footprint is 0.01 Mt CO2, which can be compared to the carbon footprint of Faroe Islands with a population of 53 000 people.

Proof-of-Stake clearly provides an alternative approach to consensus that avoids the computational power-intensive process of PoW.

What makes Nano stand out

From the very beginning nano was created to perform efficiently without the need for mining. Unlike Ethereum or Bitcoin, nano is based on the Open Representative Voting (ORV) consensus mechanism, which uses delegated, weight-based voting, allowing consensus to be achieved with minimal resource usage. It provides low costs for handling transactions at volume and thus removes the need to incentivize participation with on-chain rewards. This results in significantly lower energy consumption and carbon emissions compared to PoW and PoS-based cryptocurrencies, making nano an environmentally friendly and sustainable currency for a greener future.

A brief history and mission

Nano (XNO) was launched in October 2015 by Colin LeMahieu, the project began in 2014 as RaiBlocks and rebranded to Nano in 2018. From its inception, nano aimed to be a cryptocurrency that would be suitable for everyday use without compromising on environmental concerns. XNO’s mission aligns perfectly with the current need for carbon-neutral alternatives in the crypto space.

Unlike traditional blockchains like Ethereum, nano utilizes a Directed Acyclic Graph (DAG) architecture. Transactions are processed by the account holder's computational power. There is no competition about who gets to create the next block, as each user creates their own blocks. This results in no transaction fees and low emissions, further reducing the energy consumption associated with transaction processing. These factors contribute to Nano's minimal carbon footprint, making it an environmentally friendly choice for cryptocurrency users.

The energy usage of a single nano transaction has been calculated as low as 0.111Wh. Nano generates a carbon footprint in the amount of 0.04 g CO2e per transaction, while a single ETH transaction generates 0.02 kg CO2e. No other cryptocurrencies beat these results.

Despite its many benefits, nano faces challenges in the market due to user preferences for get-rich-quick schemes. However, stability and low volatility are crucial for the future adoption and mainstream use of cryptocurrencies, which makes XNO a strong candidate for the future of everyday cryptocurrency use.

Conclusion

In conclusion, nano has an auspicious vision for the future of cryptocurrency. Not only is it currently a low-emission and fast transaction option, but it also has the potential to be even more eco-friendly in the future. Additionally, nano's fast transaction times make it an ideal choice for everyday use, allowing for quick and easy transactions without the wait times associated with other cryptocurrencies.

In the pursuit of a carbon-neutral future for crypto, you can purchase XNO on SwapSpace. Nano is available for exchange with 1850+ other crypto on our platform. With a growing number of trading pairs, swapping nano has never been easier, faster, and safer.