Buy Stacks with a credit card

You can buy STX for USD and other fiat currencies here at SwapSpace! We provide an easy way to do that via one of our partners, such as Mercuryo, Guardarian, or Simplex, with a few simple steps right on this page. You can also look at Stacks price dynamics and history, get some answers to your questions, and find some useful links to read more about what is STX.

Stacks live price chart

STX price can be volatile. You can see the history of price changes in the cryptocurrency price chart below to help you make the best decision while considering buying crypto.

As you can see, the current Stacks price is 1.79354747686403. In any case, whether you want to buy the dip or just want to buy STX for your personal needs - we got you!

What is STX crypto?

The Stacks blockchain is a blockchain protocol designed to bring smart contracts and decentralized applications (DApps) to the Bitcoin network. It operates as an open-source project, and its development is led by Hiro PBC (previously Blockstack PBC). Stacks uses a unique consensus mechanism known as Proof of Transfer (PoX) to attach a separate blockchain (the Stacks blockchain) to the Bitcoin blockchain.

The Stacks network, formerly known as Blockstack, was co-founded by Muneeb Ali and Ryan Shea. Muneeb Ali is a computer scientist who completed his Ph.D. in distributed systems from Princeton University, and Ryan Shea is a computer scientist and entrepreneur. They founded Blockstack in 2013 with the vision of building a decentralized computing platform that would empower users and developers by giving them more control over their data and digital identities.

Early glimpses of the project's vision can be found in Muneeb's TEDx talk. Notably, in 2019, the project achieved a significant milestone with the first-ever SEC-qualified token offering, as reported in a Wall Street Journal article. This offering was made accessible to the general public, including those in the United States. The comprehensive offering material provided detailed insights into the project, the company, and the individuals involved.

In 2019, the Blockstack Token (STX) was launched as part of the transition to the Stacks 2.0 blockchain. The name change from Blockstack to Stacks occurred around the same time, and the project continued to evolve, introducing the Proof of Transfer (PoX) consensus mechanism and the Clarity smart contract language.

From 2018 to 2020, the team dedicated their efforts to developing the Stacks infrastructure—a programming layer designed for Bitcoin. This infrastructure functions akin to a blockchain with cross-chain consensus alongside Bitcoin. Additionally, they introduced the Clarity language, a secure programming language. You can find technical resources related to these developments here.

The consensus mechanism used by Stacks is Proof of Transfer. In PoX, miners on the Stacks blockchain attach new blocks to the Bitcoin blockchain by burning (or locking up) a certain amount of STX tokens. This is intended to align the incentives of both networks and enhance security.

The Stacks blockchain is built on top of the Bitcoin blockchain and uses a consensus algorithm called Proof of Transfer (PoX). STX is the native cryptocurrency of the Stacks blockchain.

Proof of Transfer (PoX) serves as the link between the Bitcoin and Stacks blockchains, expanding the capabilities of Bitcoin. Stacks introduces smart contracts and scalable transactions to Bitcoin without requiring any modifications to the Bitcoin protocol. The implementation of PoX involves utilizing Bitcoin as the foundational chain and connecting it with Stacks as a complementary chain.

Stacks aims to enable the execution of smart contracts on the Bitcoin network, which traditionally does not support native smart contracts. Stacks uses a language called Clarity for writing smart contracts. Clarity is designed to be simple, predictable, and secure.

Stacks enables the development of decentralized applications on its blockchain. These applications can leverage the security of the Bitcoin network. The Stacks ecosystem provides a suite of developer tools and resources to facilitate the creation of decentralized applications. This includes documentation, APIs, and other tools to streamline the development process.

STX tokens are used for various purposes within the Stacks ecosystem, such as participating in the consensus mechanism, registering digital assets, and interacting with smart contracts.

STX tokens can be also utilized in decentralized finance (DeFi) applications built on the Stacks blockchain. This includes activities such as lending, borrowing, and other financial transactions within the decentralized ecosystem.

The STX token has a total supply of 1,818,000,000 STX, and as of December 23, 2023, the circulating supply is 1,429,045,570 STX.

STX is actively traded on numerous leading exchange platforms, expanding its accessibility to a broader audience. Notable exchanges where traders can buy STX include Binance, Coinbase, Kraken, Upbit, KuCoin, and several others.

The average fees on the STX

As of now, Stacks transaction fees can be as minimal as 0.00018 STX, equivalent to less than one cent.

The STX token wallets

Users can store STX tokens in compatible wallets that support the Stacks blockchain, such as Hiro Wallet (the official wallet provided by Hiro PBC, the entity behind Stacks), Stacks Wallet, Ledger, Guarda Wallet, Atomic Wallet, My Ether Wallet, etc.

How to buy STX on SwapSpace

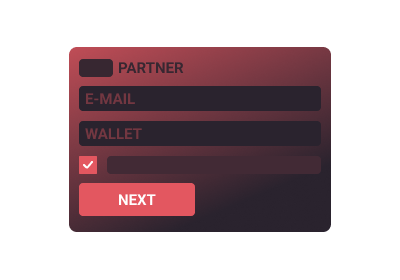

On this page, we put USD in the “You send” and STX in the “You get” sections in the widget. USD is the default, but you can choose your preferred fiat currency. Put in the amount of fiat you want to spend. Next, press the ”View offers” button and choose a provider.

Fill in the “Enter the recipient address” field with the destination Stacks address. Check the information carefully and click the “Next” button. After reading the special terms and conditions in the next window, click “Next” again.

At this point, you will either see our partner’s widget or be redirected to another page, depending on the chosen provider. You will be asked to verify your identity, as this is standard practice for the services that work with fiat money. Follow the provider’s instructions on the screen.

After completing the KYC procedure, fill in your credit card information. At this point, everything is in place and your transaction will start.

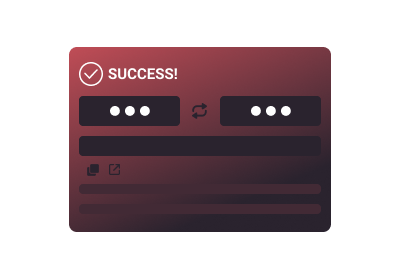

Wait for the transaction to process. You’ll see a message when it’s completed. A window with your transaction details will also appear; from there, you can also create another crypto-fiat exchange.

Frequently asked questions

Is there a way to predict Stacks future price?

Are there limits for buying Stacks?

Can I purchase STX with other crypto instead of fiat?

Other popular crypto to buy now

Changed your mind about buying stx? Think that another coin is the best crypto to buy now? Take a look at other offers! Or you can exchange crypto-to-crypto.