Buy Aave with a credit card

You can buy AAVE for USD and other fiat currencies here at SwapSpace! We provide an easy way to do that via one of our partners, such as Mercuryo, Guardarian, or Simplex, with a few simple steps right on this page. You can also look at Aave price dynamics and history, get some answers to your questions, and find some useful links to read more about what is AAVE.

Aave live price chart

AAVE price can be volatile. You can see the history of price changes in the cryptocurrency price chart below to help you make the best decision while considering buying crypto.

As you can see, the current Aave price is 162.340940802948. In any case, whether you want to buy the dip or just want to buy AAVE for your personal needs - we got you!

How to buy AAVE on SwapSpace

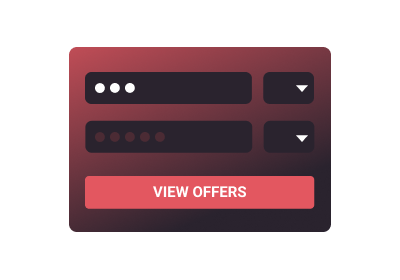

On this page, we put USD in the “You send” and AAVE in the “You get” sections in the widget. USD is the default, but you can choose your preferred fiat currency. Put in the amount of fiat you want to spend. Next, press the ”View offers” button and choose a provider.

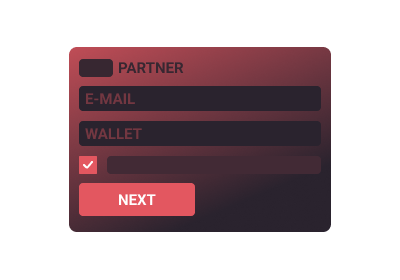

Fill in the “Enter the recipient address” field with the destination Aave address. Check the information carefully and click the “Next” button. After reading the special terms and conditions in the next window, click “Next” again.

At this point, you will either see our partner’s widget or be redirected to another page, depending on the chosen provider. You will be asked to verify your identity, as this is standard practice for the services that work with fiat money. Follow the provider’s instructions on the screen.

After completing the KYC procedure, fill in your credit card information. At this point, everything is in place and your transaction will start.

Wait for the transaction to process. You’ll see a message when it’s completed. A window with your transaction details will also appear; from there, you can also create another crypto-fiat exchange.

Frequently asked questions

Is there a way to predict Aave future price?

Are there limits for buying Aave?

Can I purchase AAVE with other crypto instead of fiat?

Other popular crypto to buy now

Changed your mind about buying aave? Think that another coin is the best crypto to buy now? Take a look at other offers! Or you can exchange crypto-to-crypto.

Curious for more?

Join our newsletter — stay informed, stay empowered.